Makara Sankranti 2026: Your 30-Day Stock Market Playbook

The Cosmic Shift That Changes Everything (Jan 14 - Feb 13)

This month, the Sun moves into Capricorn on January 14th. That might sound like astrology jargon, but here’s what it means for your wallet: the next 30 days are packed with big market swings, clear winners, and obvious losers. Banks, oil companies, and defense stocks are about to lead. Tech stocks? Buckle up for a bumpy ride.

Energy: Mixed but opportunistic. Volatility today, recovery tomorrow, strength by late February.

What Happens on January 14?

The sun enters Capricorn. In simple terms: the market’s mood shifts from soft to hard, from growth-at-any-cost to structure-and-substance. Banks win. Governments get attention. Oil rallies. Startups get hit.

This shift lasts 30 days and affects every major stock market on Earth. Here’s what you need to know:

January 14-20: Setup phase. Energy stocks surge. Tech stocks stumble.

January 17-18: Extreme volatility day. Avoid unless you’re experienced.

January 28-29: Another rough patch. Growth stocks get hammered.

January 30: The golden entry day. Recovery starts here. Buy quality on dips.

February 4-13: Strength returns. Final rally. Book profits by Feb 13.

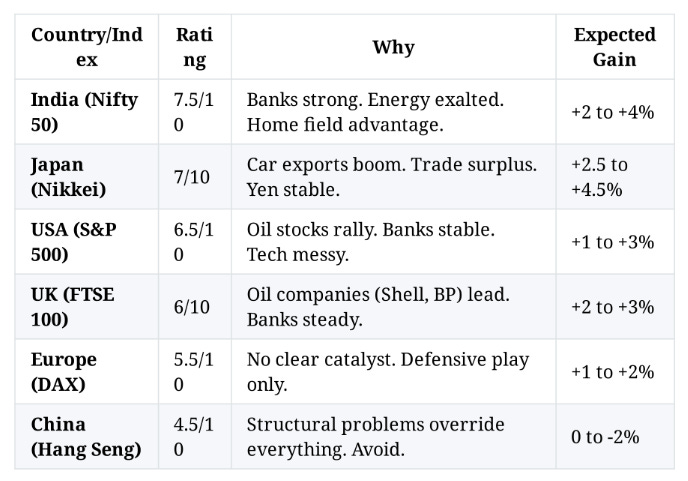

Which Countries Win? Which Lose?

Which Sectors Get Rich? (Buy These)

The Absolute Winners (Buy on dips Jan 30-31)

1. Oil & Gas (Energy)

Companies: Exxon Mobil (USA), Reliance & ONGC (India), Shell & BP (UK)

Why: Mars (energy planet) is exalted in Capricorn. Strongest signal of the entire period.

Target: +5 to +7% over 30 days

2. Defense & Aerospace

Companies: HAL & BEL (India), Lockheed & Raytheon (USA), BAE Systems (UK)

Why: Mars rules weapons. Sun aspect supports government spending.

Target: +6 to +8% over 30 days

3. Banks & Financial Services

Companies: HDFC Bank & ICICI (India), JPMorgan & Bank of America (USA), HSBC (UK)

Why: Capricorn = institutions = banking season. Saturn supports long-term strength.

Target: +3 to +5% over 30 days

4. Pharmaceuticals

Companies: Sun Pharma & Cipla (India), Johnson & Johnson & Pfizer (USA), AstraZeneca (UK)

Why: Saturn enters healing nakshatra. Export demand strong.

Target: +4 to +6% over 30 days

5. Infrastructure & Heavy Industry

Companies: L&T (India), Caterpillar (USA), Rolls-Royce (UK)

Why: Sun-Jupiter aspect on Feb 5 = government spending boost.

Target: +4 to +6% over 30 days

The Okay Sectors (Hold, don’t add)

Consumer Staples (HUL, Nestle, Unilever): Safe but boring. +1 to +3%.

Utilities (Power companies): Defensive hedge. +1 to +2%.

Automobiles (Toyota, Tata Motors): Mixed. Recover late February. +2 to +4%.

The Trouble Sectors (Reduce or Avoid)

Tech & Software (TCS, Infosys, Microsoft, Apple)

Why: Mercury (communication planet) is confused Jan 21-29. Tech gets hit hardest.

Problem: Two “planetary wars” on Jan 17-18 and Jan 28-29 create chaos in growth stocks.

Plan: Sell 50% now. Wait to rebuy after Feb 4.

Consumer Discretionary & E-commerce (Amazon, Zomato, Paytm)

Why: Luxury spending (Venus) battles tech (Mercury). Confusion reigns.

Plan: Underweight until Feb 4.

Media & Entertainment (Zee, Netflix)

Why: Communication breakdown. Earnings confusion.

Plan: Skip until Feb.

Your Action Plan (By Risk Profile)

Conservative Investor (Sleep Well at Night)

Goal: Gain 2-3% safely. Avoid sleepless nights.

What to buy (Jan 30-31):

HDFC Bank or JPMorgan Chase (Banking)

Sun Pharma or Johnson & Johnson (Pharma)

Reliance or Exxon Mobil (Energy)

HUL or Nestle (Consumer Staples)

Sell signals (if this happens):

Markets drop more than 5% in one day = close all positions, wait for dust to settle

Target: 2-3% gain by Feb 13

Moderate Investor (Balance Growth & Sleep)

Goal: Gain 4-6%. Tolerate volatility. Use stops.

What to buy (Jan 30-31):

2 energy stocks: ONGC (India) or Chevron (USA) + Reliance

2 bank stocks: HDFC Bank (India) + JPMorgan (USA)

1 defense stock: HAL (India)

1 pharma stock: Cipla (India) or AstraZeneca (UK)

Stop losses: Set at 5% below your entry price. No excuses.

Sell targets:

Take 30% profit if portfolio up 3% (by Feb 5)

Take 50% profit if portfolio up 5% (by Feb 12)

Trail remaining 20% to lock in gains

Target: 4-6% gain by Feb 13

Aggressive Investor (High Risk, High Reward)

Goal: Gain 8-12%. You can handle 10%+ daily swings. You have time.

What to buy (Jan 15-20 setup, Jan 30-31 heavy):

Energy: ONGC (India 50% position) + ConocoPhillips (USA) - use margin if available

Defense: HAL (India) + BEL (India) - these should be your core holdings

PSU Banks: Bank of Baroda (India) - undervalued turnaround play

Infrastructure: L&T (India) - wait until Jan 30 dip

Advanced moves (only if experienced):

Straddle on Nifty IT Jan 27-29 (buy 29, sell 29 evening = capture volatility)

Long energy call options expiring Feb 20 (buy Jan 15, sell Feb 12)

Short Nifty IT Jan 21-28, cover Jan 30

Stop losses: 7-8% (tighter than conservative)

Sell targets:

25% at +4% (early February)

25% at +7% (Feb 10)

Trail 50% for the full month

Target: 8-12% gain by Feb 13

The Calendar You MUST Watch

DANGER DAYS (Close positions or hedge)

January 17-18 (Friday-Saturday)

Planetary war between Mercury and Mars

Translation: Tech stocks get hammered. Communication chaos.

Plan: Close leveraged positions. Raise cash. Buy puts if you’re hedging.

January 26 (Monday)

Inauspicious planetary combo

Translation: Choppy market. No follow-through on breakouts.

Plan: AVOID new buys. Don’t chase rallies or dips.

January 28-29 (Wednesday-Thursday)

Planetary war between Mercury and Venus

Translation: Consumer stocks + tech fight. 2-3% swings expected.

Plan: Stay in cash or use very tight stops. Not for beginners.

GOLDEN DAYS (Accumulate quality stocks)

January 15 (Thursday)

Mars enters Capricorn (exaltation)

Translation: Energy rally begins.

Plan: Start nibbling energy stocks.

January 30 (Friday) - YOUR BIG DAY

Jupiter enters new nakshatra (Punarvasu = renewal)

Translation: Market finds bottom. Recovery rally starts.

Plan: Deploy 50-60% of your cash here. This is the entry everyone’s waiting for.

January 31 (Saturday)

Venus enters wealth-focused nakshatra

Translation: Banks and financial services rally.

Plan: Add to banking positions.

February 5 (Thursday)

Sun-Jupiter positive aspect

Translation: Government infrastructure spending cycle activates.

Plan: Add L&T and infrastructure stocks.

February 12 (Thursday)

Sun moves out of debilitation zone

Translation: Market relief rally.

Plan: Final additions. Prepare to book profits Feb 13.

What Could Go Wrong? (Risk Radar)

Risk 1: Geopolitical Shock (War, Terror)

Markets drop 5-10% unexpectedly

Action: Close all positions. Move to 80% cash. Wait 3 days for dust to settle.

Risk 2: Central Bank Surprises (Emergency Rate Hike)

Your stock targets won’t hold

Action: Sell immediately. Don’t wait for stop loss to trigger. Reassess.

Risk 3: Major Earnings Miss (Tech Earnings Weakness)

Tech stocks fall more than expected. Drags markets down.

Action: You already underweighted tech. You’re safe. Stick to plan.

Risk 4: Energy Price Collapse (OPEC+ Surprise)

Oil drops 10%. Your energy plays get hit.

Action: Exit energy positions immediately. Shift gains to defensive: pharma, consumer staples.

Risk 5: January 30 Recovery Fails

No bounce on the “golden day”

Action: Don’t force it. Wait for Feb 5. If Feb 5 also fails, move to 70% cash. Reassess thesis.

Week by Week Summary

Week 1 (Jan 14-20): THE SETUP

Energy stocks jump. Tech stocks struggle.

Accumulate: Energy, Banking, Defense

Avoid: Tech, Consumer Discretionary

Risk: Medium. Jan 17-18 volatile.

Week 2 (Jan 21-27): THE CONFUSION

Mercury confused. Tech flat to down. Banking steady.

Action: Build shopping list for Jan 30.

Risk: Medium. Jan 26 choppy.

Week 3 (Jan 28-Feb 3): THE BATTLE & RECOVERY

Jan 28-29: Extreme volatility. Then recovery starts Jan 30.

Action: Accumulate aggressively Jan 30-31.

Risk: High Jan 28-29. Low after Jan 30.

Week 4 (Feb 4-13): THE RALLY

Government spending themes. Infrastructure rallies. Banking holds. Energy maintains.

Action: Buy dips. Book profits Feb 12-13.

Risk: Low. Smooth sailing.

The Bottom Line

Makara Sankranti 2026 is a traders paradise if you follow the calendar. The path is clear:

Jan 14-20: Energy wins. Tech loses. Position accordingly.

Jan 21-29: Chop and volatility. Be defensive. Build cash.

Jan 30-31: Accumulation bonanza. Deploy 50-60% of cash on quality stocks.

Feb 4-13: Recovery and strength. Add on dips. Book 30-50% profits by Feb 13.

You don’t need to predict the unpredictable. You just need to follow the seasonal market rhythm and trust that banks, oil, and defense stocks lead when Saturn and Mars align this way.

What’s Your Move?

Choose your risk profile above. Build your watchlist THIS WEEK. Set your entry prices for Jan 30. The money is made for those who are ready when opportunity arrives.

The cosmic shift happens January 14. Be ready.

Legal Reminder

This analysis is for educational and entertainment purposes only. Not financial advice. Consult a licensed financial advisor before investing. Markets carry risk of total loss. Past performance of astrological patterns does not guarantee future results. Only invest what you can afford to lose.