Rahu in Shatabhisha (Nov 2025 - Aug 2026): The Commodity Healing Cycle That's Different From 2007

When Rahu shifts into Shatabhisha on November 23, 2025, something unusual happens in financial markets. This nakshatra known as “a hundred physicians” triggers transformational cycles in commodities. The last time Rahu occupied this sign was 2006-2008, and it coincided with history’s most dramatic commodity boom and crash.

But here’s what most people miss: this cycle will be radically different.

The 2007-2008 Supercycle: A Perfect Storm

Eighteen years ago, five conditions aligned perfectly to create a 200%+ commodity rally followed by a devastating crash:

Explosive demand from Asia. China and India grew at 9-10% annually. Emerging market consumers wanted protein, energy, and manufactured goods. This wasn’t modest growth—it was an acceleration that the world’s supply chains couldn’t match.

Supply evaporated. Poor harvests hit grain-producing regions. Global cereal stocks hit historic lows. Wheat doubled in six months. Rice hit ten-year highs. These weren’t speculative moves—farmers literally couldn’t produce enough food.

Oil spiraled. Crude moved from $92 to over $200 per barrel. Higher oil meant higher fertilizer costs (which require natural gas). It meant higher transportation costs. It meant inflation everywhere. The spiral was self-reinforcing.

Governments mandated biofuels. The U.S. and EU pushed ethanol and biodiesel. Suddenly, 15% of the U.S. corn crop went to fuel, not food. A World Bank study later concluded that biofuels accounted for 70-75% of the food price spike.

Money flooded in. Leverage was excessive. Hedge funds piled into commodity futures. The dollar weakened, making dollar-priced commodities cheaper for foreign buyers. Speculation became its own bubble.

Then came 2008. The financial system nearly broke. Credit froze. Demand evaporated overnight. Commodities crashed 50-75%. It was apocalyptic.

November 2025: A Different Foundation

Today, none of those five conditions exist in the same form. Yes, Rahu has entered Shatabhisha again. Yes, that nakshatra carries transformational energy. But the macroeconomic soil is completely different.

Growth is moderate, not explosive. Global growth in 2025 is projected at 3.2% for 2026. India is growing at 6.7-6.9% strong, but nothing like the 9-10% boom of 2007. China is decelerating, not accelerating. We’re in a steady-state world, not an acceleration.

Supplies are adequate. There are no widespread harvests failures. Global grain inventories are ample. The supply shock that defined 2007-2008 simply isn’t present.

Oil remains weak. At $57-58 per barrel, crude is trading in equilibrium, not soaring. It’s down 18% year-over-year. Yes, there are geopolitical tensions (Yemen, Red Sea shipping), but there’s no supply emergency. Electric vehicles are eating into demand. This is structural, not cyclical.

Biofuels are priced in. Renewable energy policy is established. Ethanol mandates exist, but they’re not a surprise anymore. The shift toward electrification has actually reduced biofuel ambitions. No more dramatic crop diversions.

Financial systems are stronger. Yes, central banks have eased. But leverage is measured compared to 2007. Household balance sheets are healthier. Bank capital ratios are far higher. Regulatory oversight works. When the correction comes, it won’t destroy the financial system.

So Rahu enters Shatabhisha in a world that looks superficially like 2007, but structurally like 2025. That’s the disconnect that matters.

What November-December 2025 Actually Shows

Real data from late November tells the story:

The RBA commodity index rose just 1.4% in November, a single month. In 2007, monthly swings were 5-10% regularly. Gold is strong (+5.6% monthly), and silver is surging (+17.2% to all-time highs), driven by monetary dovishness and geopolitical hedging. But copper is only up 1.9% monthly, and wheat is down 2.29%. This is not a broad commodity boom. This is a bifurcated market, precious metals and energy transition metals strong, energy and agriculture weak.

The dollar fell 10.7% in the first half of 2025, which should have ignited oil. It didn’t. Oil is down despite dollar weakness. In 2007, a weakening dollar would have triggered a rally. The lack of response signals weak underlying demand.

This is the key insight: In November 2025, the conditions for a 2007-style supercycle simply don’t exist.

The “Boom Lite” Forecast: November 2025 - August 2026

Instead of a supercycle, expect a moderate bull market with selective strength:

November-December 2025 (+3-8% precious metals, flat oil)

Precious metals rally on Fed dovishness. Gold +3-5%, silver +5-8%.

Copper gains +2-4% on clean energy optimism.

Oil stays range-bound, lacking either supply shock or demand surge.

Crypto enters bullish phase on innovation themes.

January-March 2026 (+2-7% metals, +5-10% oil)

Post-holiday consolidation gives way to Q1 optimism.

Oil begins to respond as winter heating demand persists.

Copper and metals continue rising on AI infrastructure buildout (data centers, renewable grids).

Agricultural commodities show mixed signals as planting season approaches.

April-June 2026 (Peak euphoria: +10-15% oil, +5-8% copper)

This is the critical window. Summer air conditioning demand peaks. Oil accelerates.

Copper experiences strongest gains as AI server buildout, data center construction, and EV supply chain expansion all hit peak.

Precious metals begin to top as interest rate risk emerges.

Crypto enters extreme euphoria.

This mirrors the peak euphoria of mid-2008 in timing but with far less magnitude and no financial crisis to follow.

July-August 2026 (Correction: -15-25% oil, -3-8% copper, -5-10% gold)

The trigger: Recession fears in advanced economies, combined with recognition that AI profit growth may be disappointing.

Fed stops cutting rates. Treasury yields rise. Equity valuations compress.

Oil crashes -15-25% as growth expectations collapse.

Copper falls -3-8% as capex slowdowns hit.

Gold corrects -5-10% as rates rise (but holds better than other commodities).

Agricultural commodities fall -5-10%.

Crypto faces severe drawdowns (30-50% from peaks) as speculative flows reverse.

The 9-month net return:

Copper: +5-12% (clean energy structural tailwind survives)

Gold: -2-5% (strong into June, weak in July-Aug)

Silver: -5-10% (more industrial exposure, gets hit harder)

Oil: -5-10% (strong summer peak, severe August crash)

Agriculture: -5-10% (weak throughout)

Crypto: +30-50% net (extreme gains before crash, but starts from oversold)

This is not a 2008-style systemic crash. This is a healthy correction within a moderate bull cycle.

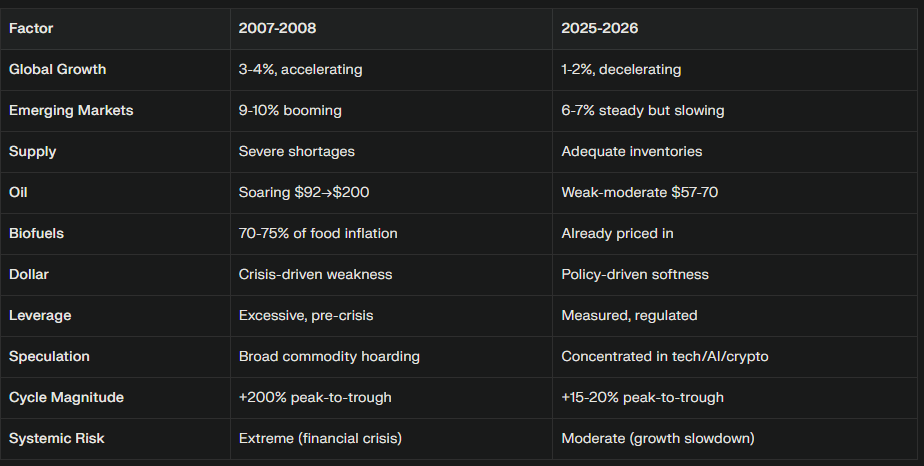

The Real Difference: 2007 vs 2025

Your Action Plan: November 2025 - August 2026

Buy and hold through June:

Copper futures or ETFs: The asymmetric winner. Long-term structural demand from clean energy, AI infrastructure, and EV buildout creates 5-12% net upside despite July-August correction. This is the core position.

Gold: The hedge. It rises into June, then corrects. Hold it for protection, not for gains.

Avoid entirely:

Oil leverage: Don’t chase oil higher before April-June. Position size must reflect July-August downside risk.

Agricultural commodities: Weather dominates. Tariffs create noise, not trends.

Broad speculation: This isn’t 2007. Don’t assume all commodities rise together.

Tactical trades:

November-March: Accumulate copper on any dips. Add to gold positions.

April-June: Take profits on precious metals. Take 50% profits on copper. Hold crypto through June.

July-August: Exit remaining commodity longs. This is the profit-taking window. Go to cash or rotate into defensive stocks.

Sample portfolio allocation (9 months):

40% Copper/industrial metals ETFs (hold through June, exit by July)

30% Gold (hedge throughout, sell on bounce in June)

20% Tactical oil shorts (establish in June, profit-take in August)

10% Selective crypto, Bitcoin only, not altcoins (exit by end of June)

The August 2, 2026 Exit

Rahu leaves Shatabhisha on August 2, 2026. This isn’t mystical, it’s a natural point of position unwinding. Any remaining long commodity positions should be exited or reduced by late July. This creates a natural sell-off into early August.

Mark your calendar. That’s your hard deadline.

The Bottom Line

Rahu in Shatabhisha brings transformation, but not catastrophe. In 2007-2008, the transformation came through collapse. In 2025-2026, it comes through correction. The macroeconomic foundation is too different to repeat 2007.

Ride the copper wave through June. Hedge with gold. Avoid oil leverage. Take profits by August.

Shatabhisha’s “hundred physicians” are bringing healing, not wreckage. But that healing looks like a 15-20% commodity rally followed by a healthy correction not a supercycle.

What’s your play for the next 9 months? Are you loading copper, or sitting this one out? Drop your thoughts in the comments, I read every response.